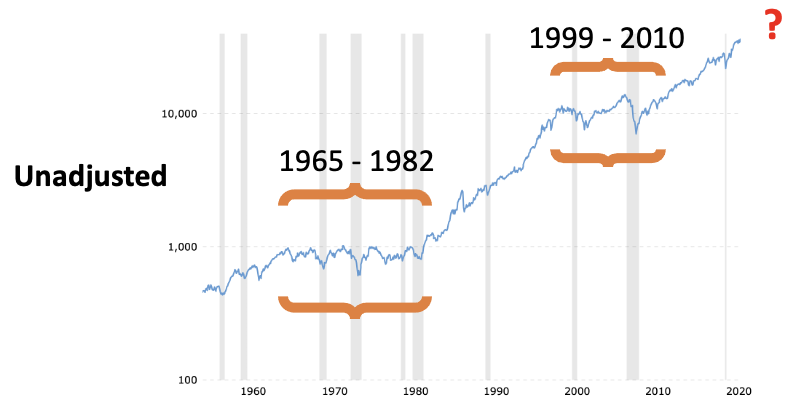

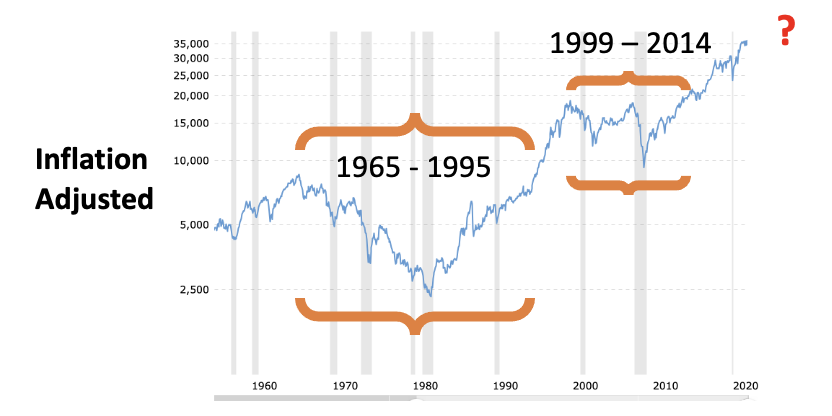

Below are a couple of charts, thanks to this website, that make a strong case for ignoring long term market trends while investing, constantly and consistently, inflation adjusted amounts over one’s working life. One might get lucky with figuring out the market trends, buying at the low points and selling at the high points, but the consistent investing strategy would have guaranteed success over the past sixty years or so. Unfortunately, as the investing industry continuously warns us, the past is no predictor of the future.

In the retirement years, however, it is too late for that consistent investing strategy, and one has to be concerned about major downward market moves (or hope for major upward market moves.)

My attitude of suspicion and skepticism about the stock markets may be unduly influenced by the fact that I entered the workforce in 1965, at the end of the 50’s and 60’s post-war boom (DJIA ~100 to ~1000), and soon started investing in stock mutual funds. The Dow toyed with 1000 in the late sixties but didn’t cross it for good until 1982 when I was solidly into middle age. (Top chart)

I was unimpressed and, as a result, missed some good opportunities.Those early years were good years for working folks, inflation resulting in good annual salary increases and shrinking mortgages, but the stock market was not very helpful. On an inflation-adjusted basis, the market went nowhere for thirty years though those who sensed that everything changed around 1980 and invested heavily at that point faired well. (Bottom chart)

The change in the early eighties was that President Reagan shifted the national attitude from gloomy to positive and figured out how to borrow and spend the excess Social Security Tax revenues by establishing a so-called trust fund holding non-tradable government bonds to kept track of how much had been borrowed and counted it as an asset rather than a liability. Read more about that here.

Like those early working years, my early retirement years, 1999 to the early teens did nothing to boost confidence in the stock market. Two busts, dot.com and real estate, within ten years and no real gains in that time period. (Either chart)

Now, in 2022, we may, or may not, be at the end of what has been an incredible 250% increase in this index in 13 years, an average of about 10% per year with inflation in the 2% range. So, after that performance, what lies ahead? I think we all know what, but just don’t know when. Current indicators, rising inflation, out-of-control government spending in pursuit of votes, and market volatility suggest that it could be sooner rather than later.

So, if a retired person’s IRA or 401K balance is important, that person should watch out below. Anybody under fifty or so and working should keep investing steadily in the future of the USA which means investing in its businesses.

Personal Note: It was spending time thinking about strategies for my own IRA that resulted in this blog post. I am not a certified financial advisor so anything I write should be viewed with extreme skepticism, the same way I view the markets. (It’s Friday afternoon, January 21, and I see the DJIA is down 7% from its January 4th high, Nasdaq down 9% from its November 19th high, and SP500 down 9% from its January 3rd high.)